mortgage sales training courses ,nmls approved mortgage originator courses,mortgage sales training courses,That’s what we help you do with our Certified Mortgage Planning Specialist (CMPS®) course, mortgage planning calculators, and personally branded expert marketing. EAT = v max /time. Fractional shortening (FS) is calculated by measuring the change (% reduction) in left ventricular diameter during systole. It is considered a poor measure of systolic function; it is only reliable if the left ventricle has normal geometry and no significant wall motion abnormalities.

In the ever-evolving landscape of the mortgage industry, the demand for skilled professionals continues to grow. As homebuyers become more discerning and the mortgage market becomes increasingly competitive, it is crucial for mortgage professionals to equip themselves with the right knowledge and skills. Mortgage sales training courses are a vital resource, offering a structured approach to understanding the intricacies of mortgage lending and sales. This article will delve into various training options available, including the Certified Mortgage Planning Specialist (CMPS®) course, and explore how these programs can significantly enhance your career prospects in the mortgage industry.

The Importance of Mortgage Sales Training

Mortgage sales training is essential for several reasons:

1. Industry Knowledge: Understanding the mortgage industry, including various loan products, market trends, regulations, and compliance, is fundamental to success. Training courses provide insights into the latest developments and best practices.

2. Sales Skills: Effective communication, negotiation, and relationship-building skills are critical in mortgage sales. Training programs focus on developing these essential sales skills.

3. Regulatory Compliance: The mortgage industry is heavily regulated. Training ensures that mortgage professionals are well-versed in compliance requirements, helping them avoid costly mistakes and protect their clients.

4. Networking Opportunities: Many training programs provide opportunities to connect with other professionals, fostering relationships that can lead to referrals and partnerships.

5. Enhanced Credibility: Completing accredited training courses adds to your credentials, enhancing your reputation and credibility in the industry.

Types of Mortgage Sales Training Courses

1. Mortgage Lending Training Courses Free

For those starting in the mortgage industry or looking to refresh their skills, free mortgage lending training courses can be a valuable resource. These courses typically cover fundamental concepts, including loan types, the loan application process, and basic sales techniques. While they may not provide in-depth knowledge, they serve as an excellent introduction to the field.

2. Mortgage Broker Training Courses Accredited

Accredited mortgage broker training courses are designed for individuals seeking to become licensed mortgage brokers. These programs are recognized by industry regulatory bodies and often include comprehensive training on mortgage laws, ethics, and best practices. Completing an accredited course can be a crucial step in obtaining the necessary licenses to operate as a mortgage broker.

3. NMLS Approved Mortgage Originator Courses

The Nationwide Mortgage Licensing System (NMLS) requires mortgage loan originators to complete specific training to obtain and maintain their licenses. NMLS-approved mortgage originator courses cover essential topics such as:

- Federal and state regulations

- Loan origination processes

- Ethical considerations in mortgage lending

- Financial analysis and underwriting principles

These courses ensure that mortgage professionals are well-prepared to navigate the complexities of the mortgage industry while remaining compliant with regulations.

4. Free Mortgage Training Courses

In addition to the fundamental free courses mentioned earlier, there are various online platforms and organizations that offer free mortgage training resources. These may include webinars, articles, and guides that cover a wide range of topics. While they may not replace formal training, these resources can be an excellent supplement for ongoing education.

5. Mortgage Loan Originator Training Program

A mortgage loan originator training program is an intensive course designed to equip aspiring loan originators with the skills and knowledge necessary for success. These programs typically cover:

- Understanding different loan products

- The loan application process

- Financial analysis and credit assessment

- Sales strategies and customer service

Participants will gain hands-on experience and learn best practices from industry experts, preparing them to excel in their roles.

6. Mortgage Loan Originator Courses

Mortgage loan originator courses provide a comprehensive understanding of the mortgage origination process. These courses cover everything from understanding client needs to structuring loan options and closing deals. Participants will learn how to utilize mortgage planning calculators and develop personalized marketing strategies to attract clients.

7. Mortgage License Online Courses

Many professionals prefer the flexibility of online learning, and mortgage license online courses cater to this need. These courses allow participants to study at their own pace while covering the necessary curriculum to obtain their mortgage licenses. Online courses often include interactive elements, quizzes, and resources that enhance the learning experience.

8. Mortgage Loan Originator Training Free

For those who may be facing financial constraints, there are free mortgage loan originator training options available. These programs offer a range of basic training materials and resources that can help aspiring loan originators start their careers without significant financial investment. While they may not be as comprehensive as paid courses, they can provide a solid foundation for further learning.

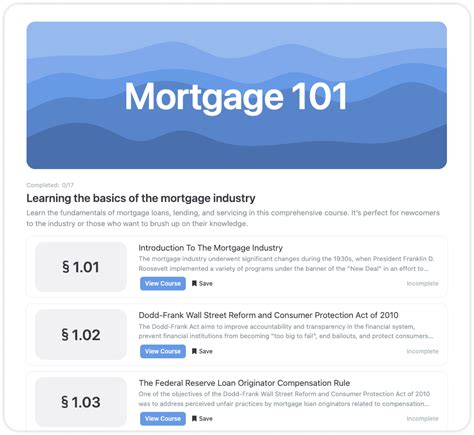

The Certified Mortgage Planning Specialist (CMPS®) Course

One of the most reputable training programs available in the mortgage industry is the Certified Mortgage Planning Specialist (CMPS®) course. This course is designed to provide participants with a deeper understanding of mortgage planning and how to integrate it into their sales processes. Key features of the CMPS® course include:

1. Comprehensive Curriculum

The CMPS® course covers a wide range of topics, including:

- The principles of mortgage planning

- Advanced mortgage strategies

- Utilizing mortgage planning calculators

- Understanding client needs and financial goals

- Creating personalized mortgage plans

This comprehensive curriculum equips mortgage professionals with the knowledge to help clients make informed decisions about their mortgage options.

2. Mortgage Planning Calculators

An essential component of the CMPS® course is the use of mortgage planning calculators. These tools allow mortgage professionals to analyze various loan scenarios, helping clients understand the long-term impact of their mortgage choices. By mastering these calculators, participants can provide valuable insights to their clients, enhancing their overall service.

3. Personally Branded Expert Marketing

In today’s digital age, effective marketing is crucial for success in the mortgage industry. The CMPS® course emphasizes the importance of personally branded expert marketing. Participants learn how to create a strong personal brand that resonates with potential clients and establishes them as trusted experts in their field. This marketing approach can significantly increase visibility and attract more clients.

4. Networking and Community

The CMPS® course provides opportunities to connect with other mortgage professionals, fostering a sense of community and collaboration. Participants can share experiences, challenges, and best practices, creating a supportive network that extends beyond the course.

Conclusion

mortgage sales training courses Here's a thorough date code guide with over 500 real examples of what Louis Vuitton date codes look on real bags! If you are a Louis Vuitton vintage handbag lover, date codes are something you want to check whenever you purchase a new luxury bag for your collection.

mortgage sales training courses - nmls approved mortgage originator courses